In Spain, not even the banks require a home inspection before financing.

One of the things that most surprises foreigners buying second hand homes in Spain, especially Brits and North Americans, is that the bank does not require a technical inspection of the property before granting a loan.This is a standard requirement in their home countries for any bank financed property purchase. Not only does the bank not require it, but the estate agent – who should be looking out for their interests – does not even mention it. It seems that in Spain, we all blindly trust the good faith of a homeowner selling their property.

Most buyers take crazy risks

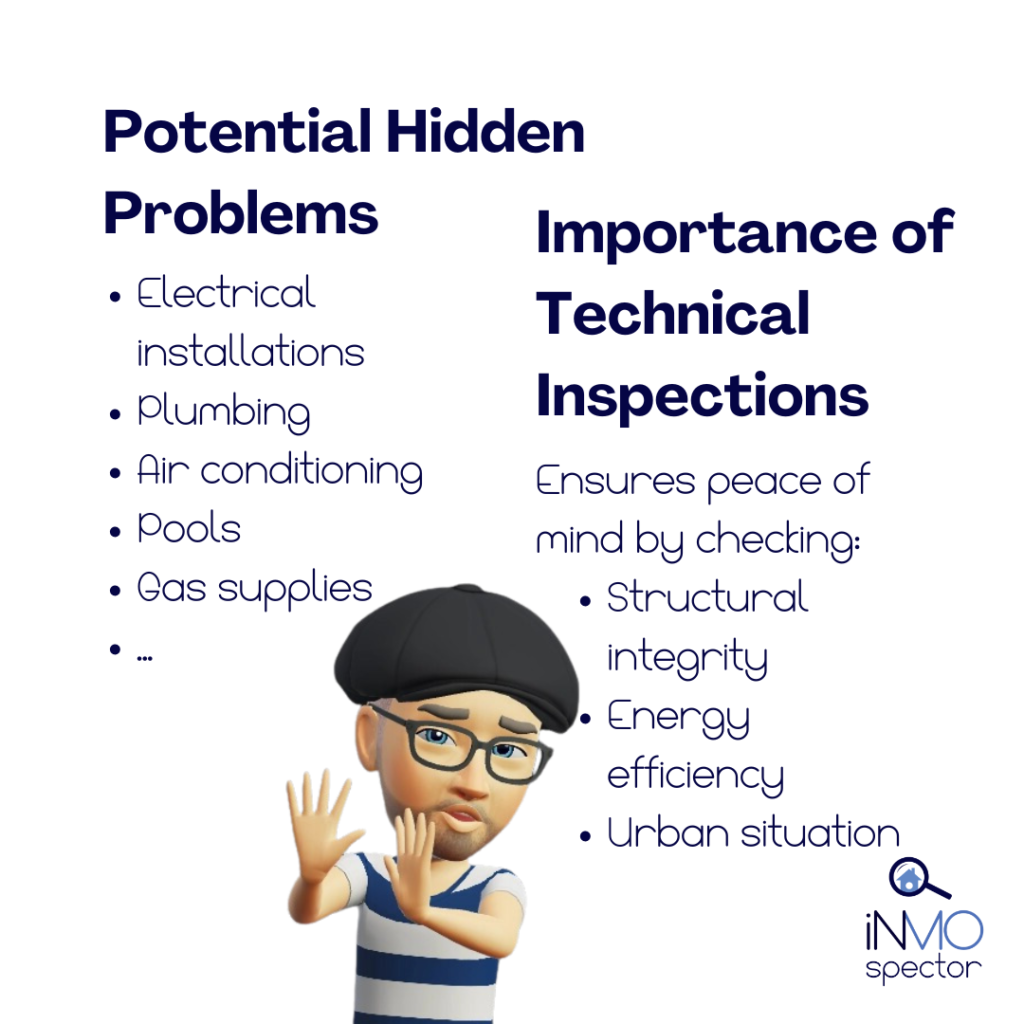

A second-hand home can hide all sorts of problems that only become apparent with time, much longer than the mere six months allowed by law to claim for such defects, a period in which few people make claims and even fewer are successful. Spending all your savings on a second-hand home without taking the precaution of knowing the state of the electrical installation, plumbing or air conditioning, not to mention the pool or gas supply, would seem crazy if it weren’t what most buyers do every day.

Not having a home inspection goes against common sense

So much so that a technical inspection of the home might seem like a strange British or North American whim, if it weren’t for the fact that ignoring it goes against the most basic common sense. And it is not very complicated to implement.Probably the same technical architect who certifies energy efficiency would be able to carry out an audit of all the installations and the urban situation of the house we want to buy.

Not having a home inspection goes against common sense

So much so that a technical inspection of the home might seem like a strange British or North American whim, if it weren’t for the fact that ignoring it goes against the most basic common sense. And it is not very complicated to implement.Probably the same technical architect who certifies energy efficiency would be able to carry out an audit of all the installations and the urban situation of the house we want to buy.

Other countries have recognized professionals

The British, in particular, have a reputable professional body, the RICS (Royal Institute of Chartered Surveyors), with well-established and recognized protocols for carrying out these “surveys” or inspections. The surveyor should have measuring instruments to check, for example, that the electrical voltage is adequate at every point in the house, or that the water flow from the taps is correct.It‘s not rocket science, but it will give the prospective buyer some well-deserved peace of mind.

A reputable vendor or estate agent should provide a conclusive report.

Furthermore, any seller acting in good faith should provide their prospective buyer with this technical report on their property as an exercise in honesty and transparency that the buyer should recognize and value in its entirety. Given the choice, the buyer will always opt for a property with a positive technical report or negotiate with the seller to remedy any defects before closing the deal.

Full protection versus lack of guarantees

Finally, I would like to point out the paradox of the exhaustive protection enjoyed by a new home buyer compared with the absence of any guarantee – apart from the aforementioned six-month complaint period – that affects the purchase of a second-hand home. A new home is only handed over to the buyer after it has been reliably certified as complying with all the regulations of the Technical Building Code in force, with additional insurance policies that guarantee for up to ten years against any construction defects that may become visible.

10-year insurance provided by law by builders and architects

The so-called ten-year insurance is in turn covered by the respective insurance policies of the builder, the developer and even the architects’ association to which the firm signing the project must belong. In short, a chain of insurances that gives the new home buyer bombproof protection.

On the other hand, the buyer of a second-hand house, who is persuaded by the notary to accept the house “as it is”, with little chance of redress, has to make do with a bit of garlic and water in the case of hidden defects.

What can I say?

If you want to buy property in Spain, contact us first!

Source: Insights from inmotools

#SpainRealEstate #PropertyInSpain #BuyInSpain #SpanishProperty #RealEstateSpain #InvestInSpain #SpanishHomes #SpainPropertyMarket #HouseHuntingSpain #LivingInSpain #SpainInvestment #SecondHandHomesSpain #DreamHomeSpain #PropertyInspection #HomeInspectionSpain #SafeInvestment #SpainHomeBuyers #INMOspector #PropertyAudit #SpanishRealty